Accounting Integration – Connect Finance with Travel Operations

Struggling to Track Frequent Transactions

moonstride brings all your financial operations together—making it easy to manage everything from one place.

Inconsistent Tax Calculations

moonstride automates tax calculations, ensuring compliance with tax regulations and accurate reporting.

Challenges in Financial Reporting & Insights

Get detailed financial summaries and custom reports, providing businesses with a clear view of profitability and cash flow.

Accounting Features That Work Behind Every Transaction

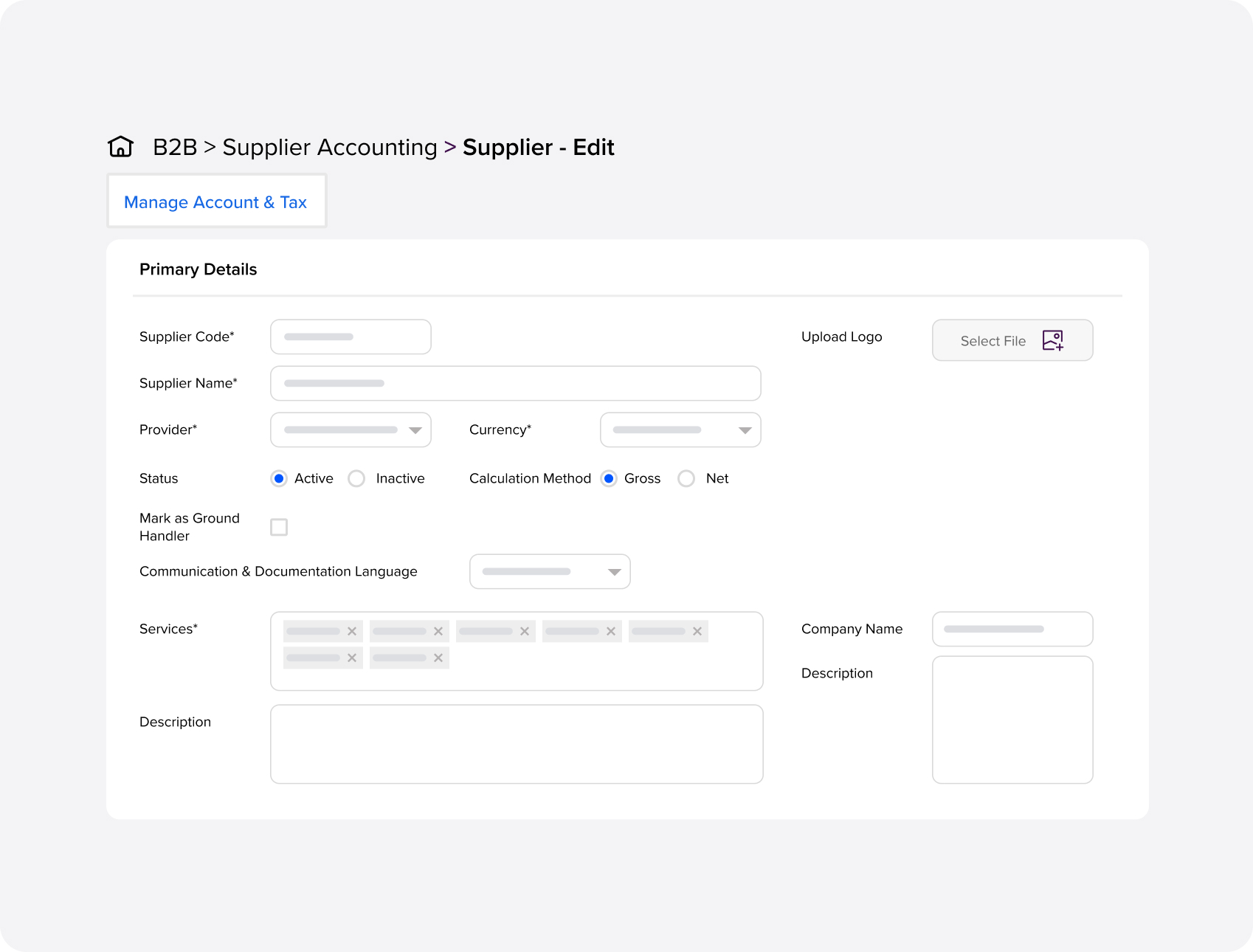

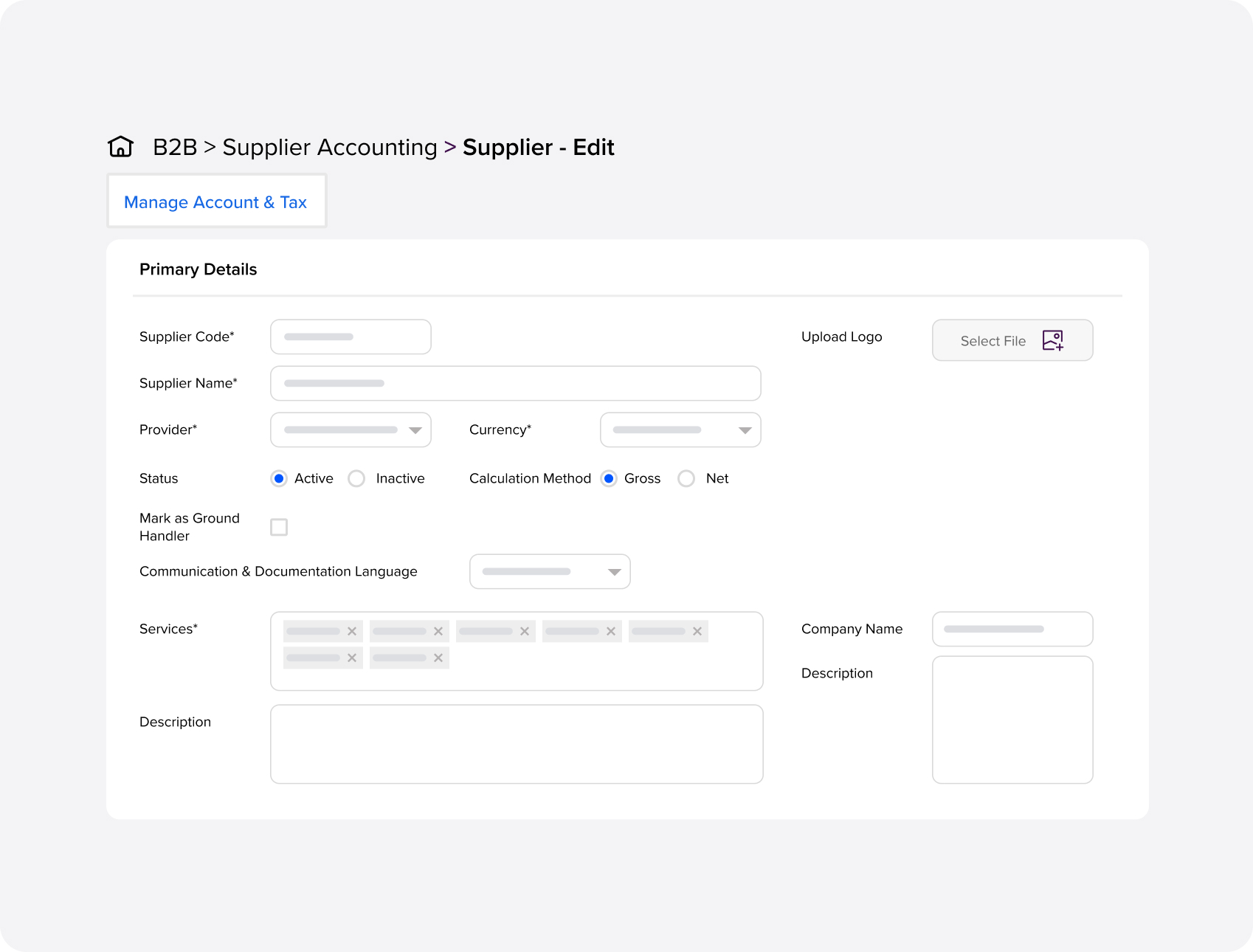

Sales & Purchase Ledger Management

- Upload supplier invoices and allocate payments quickly.

- Manage sales invoices and payments.

- Generate financial statements directly from the platform.

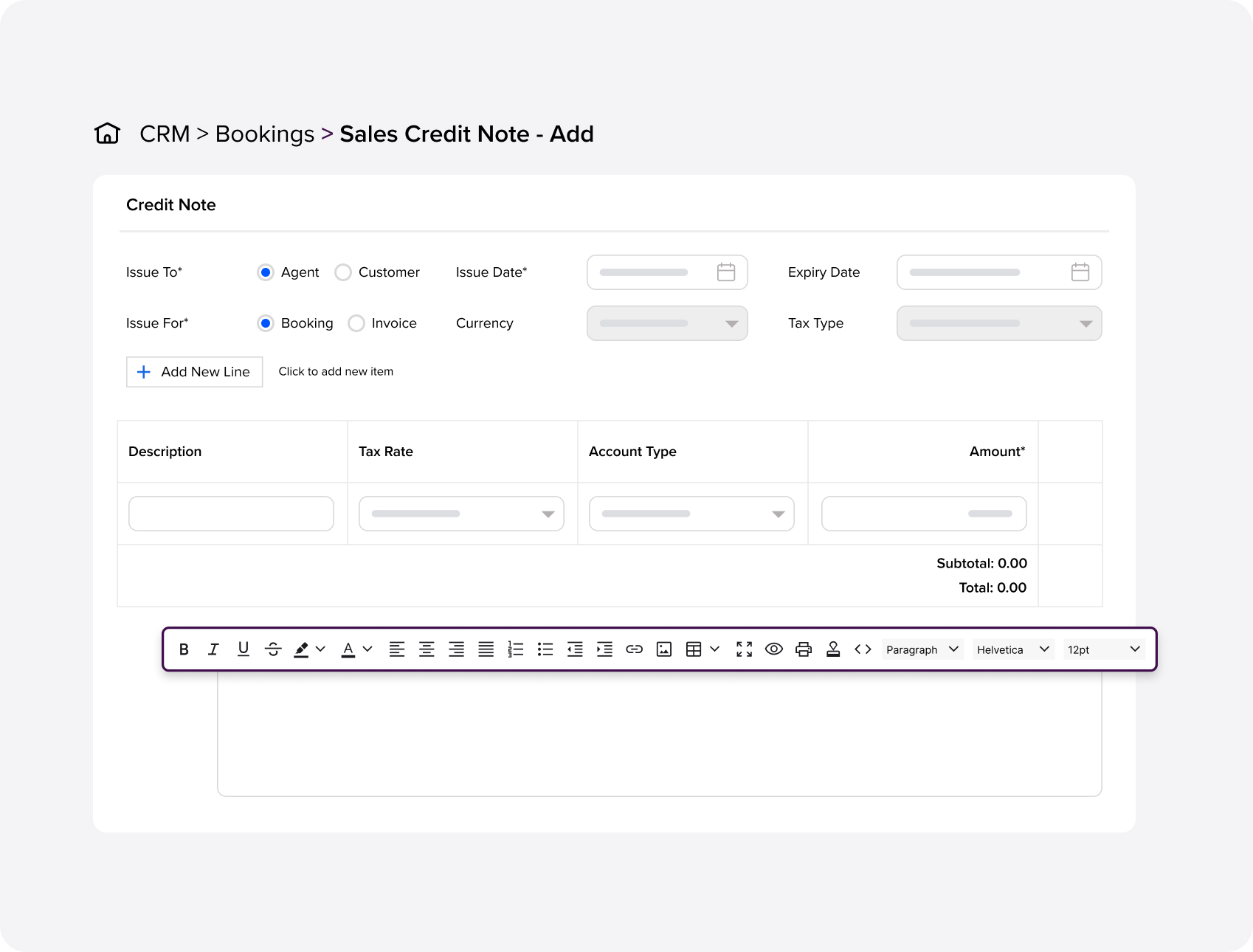

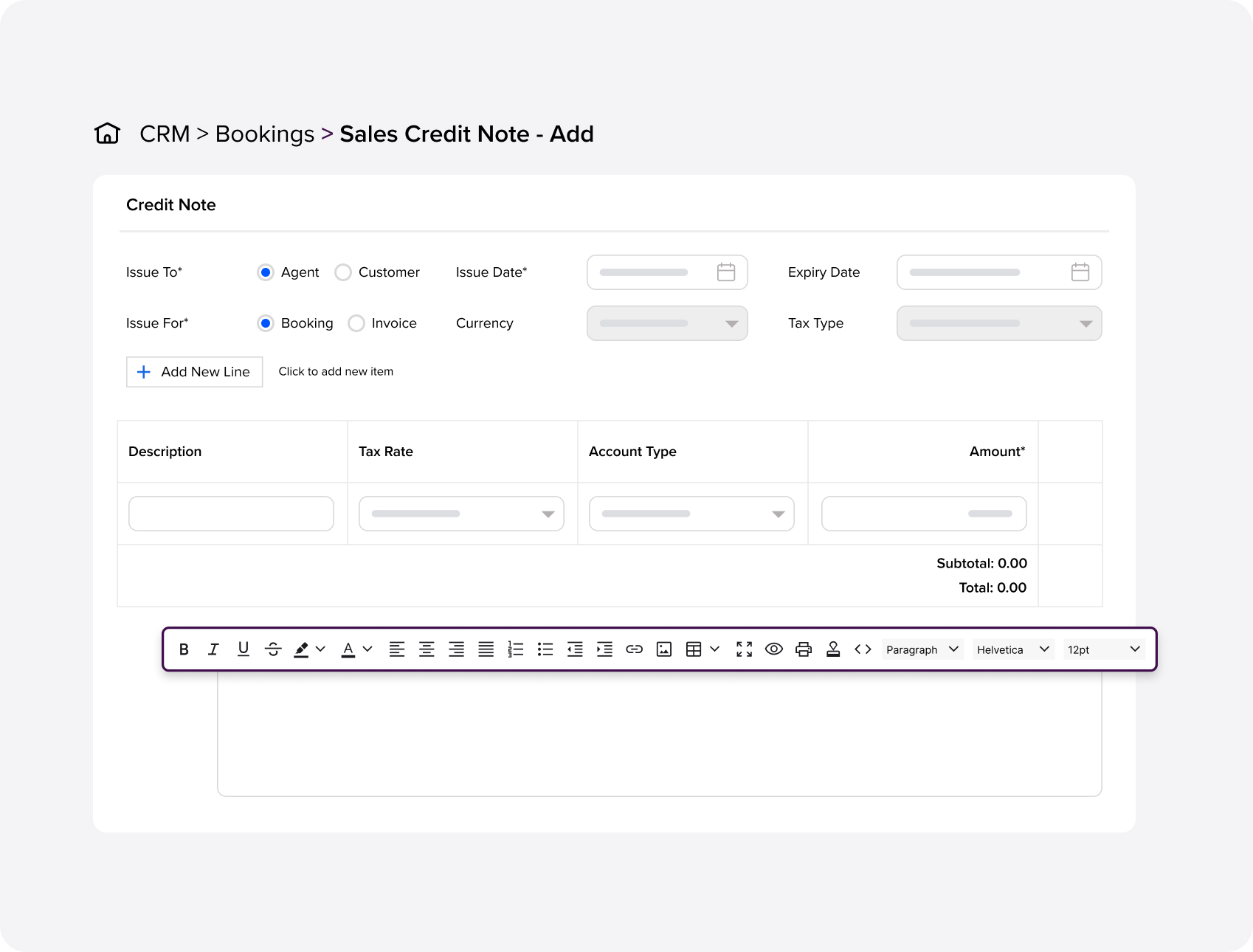

- Create and manage credit notes with full traceability.

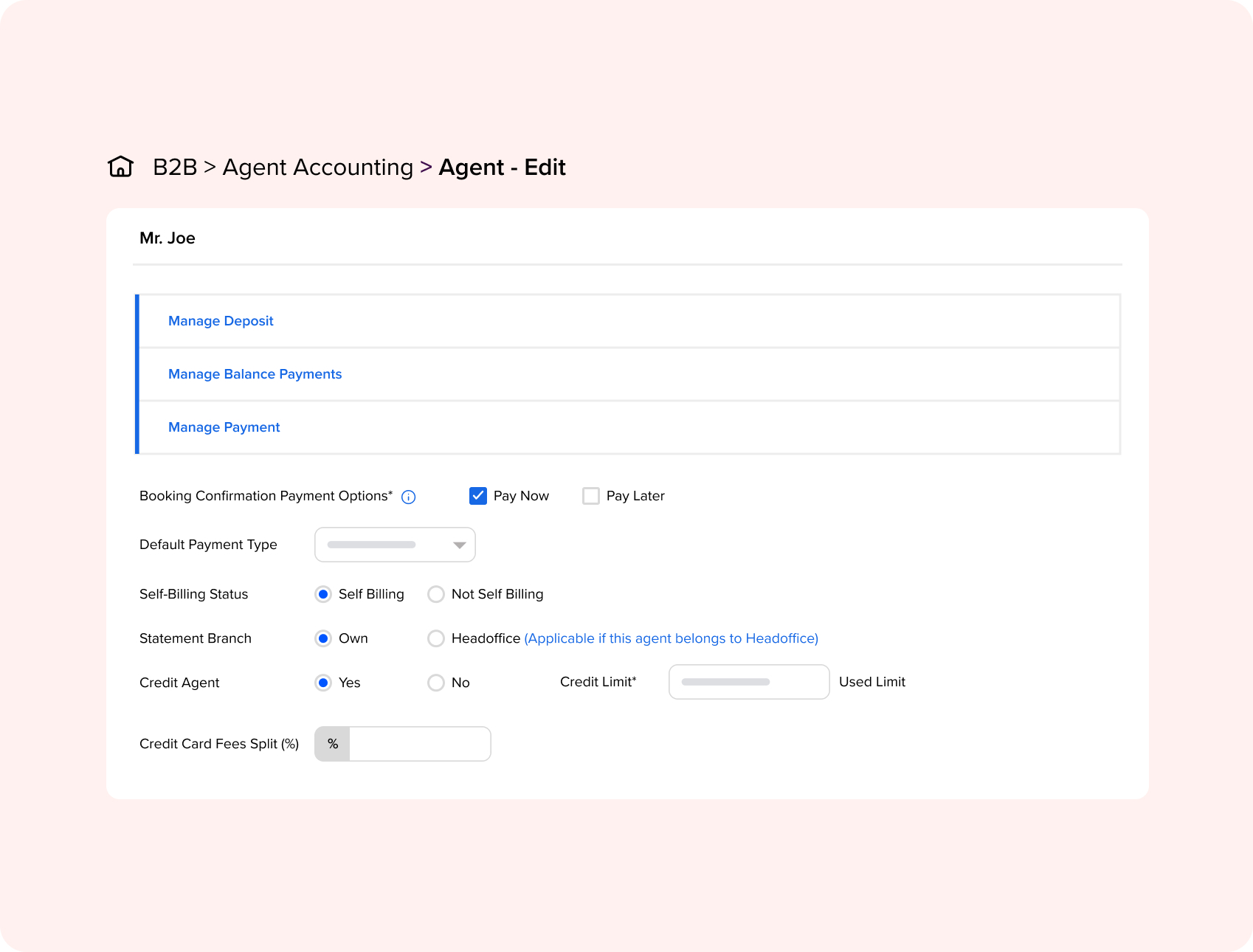

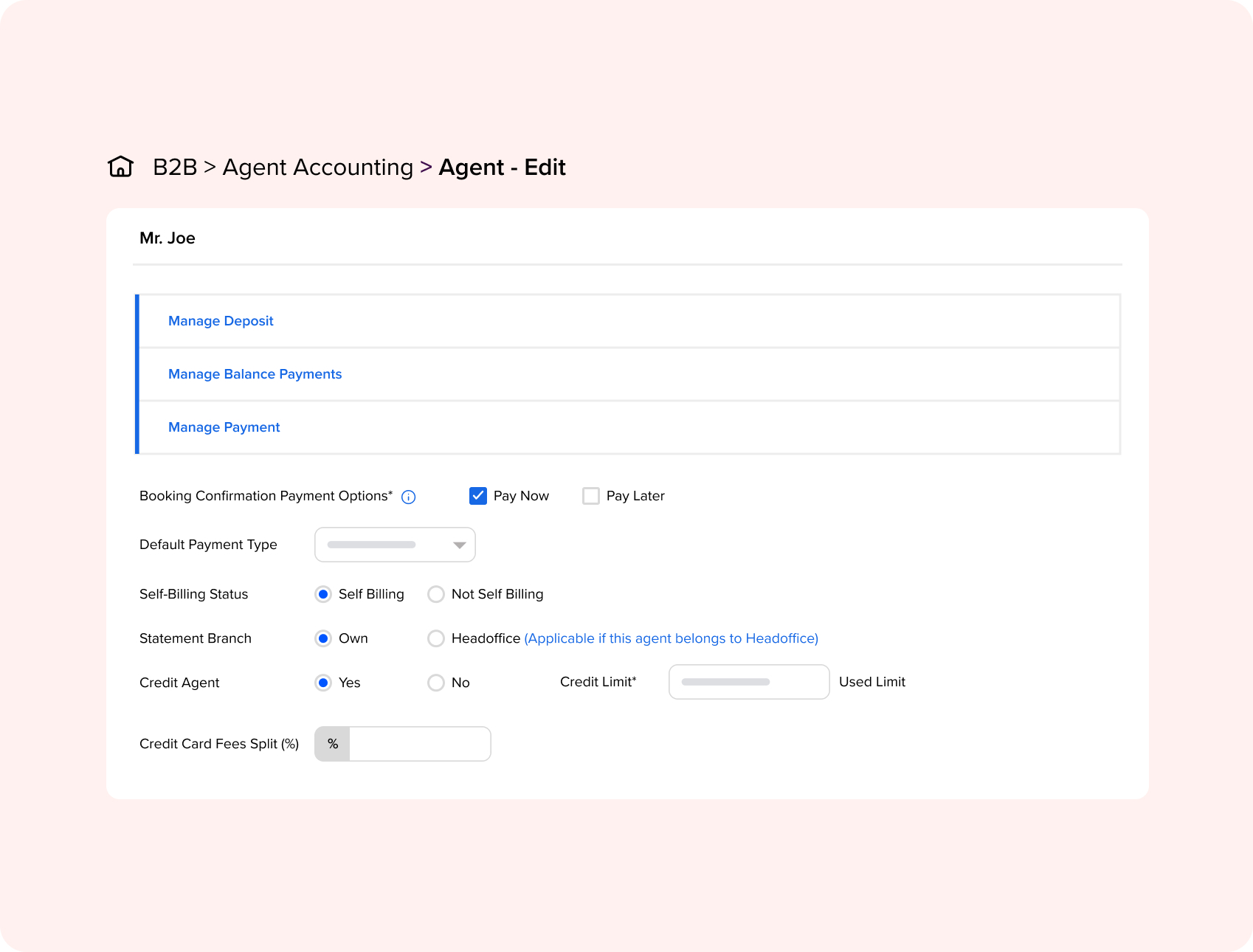

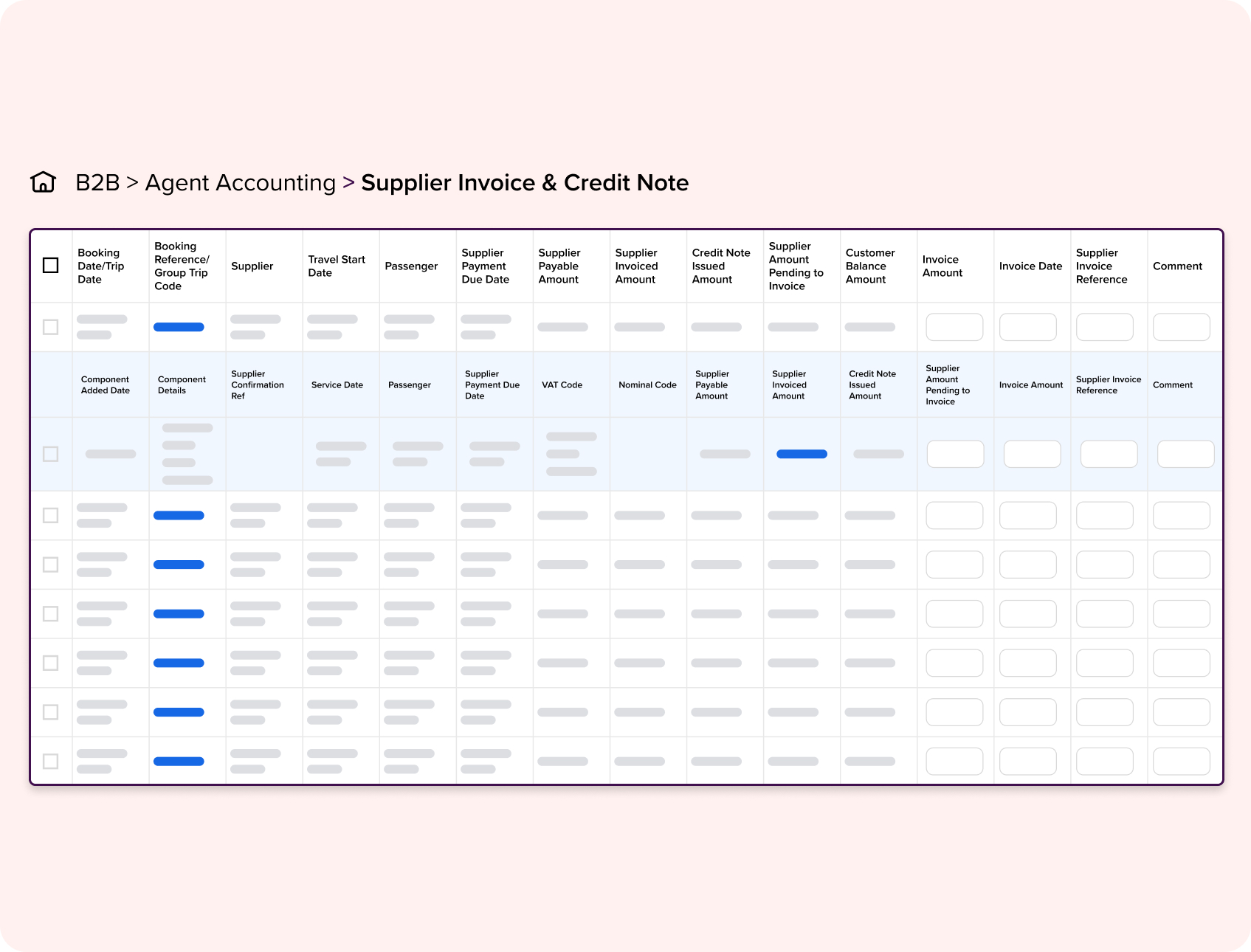

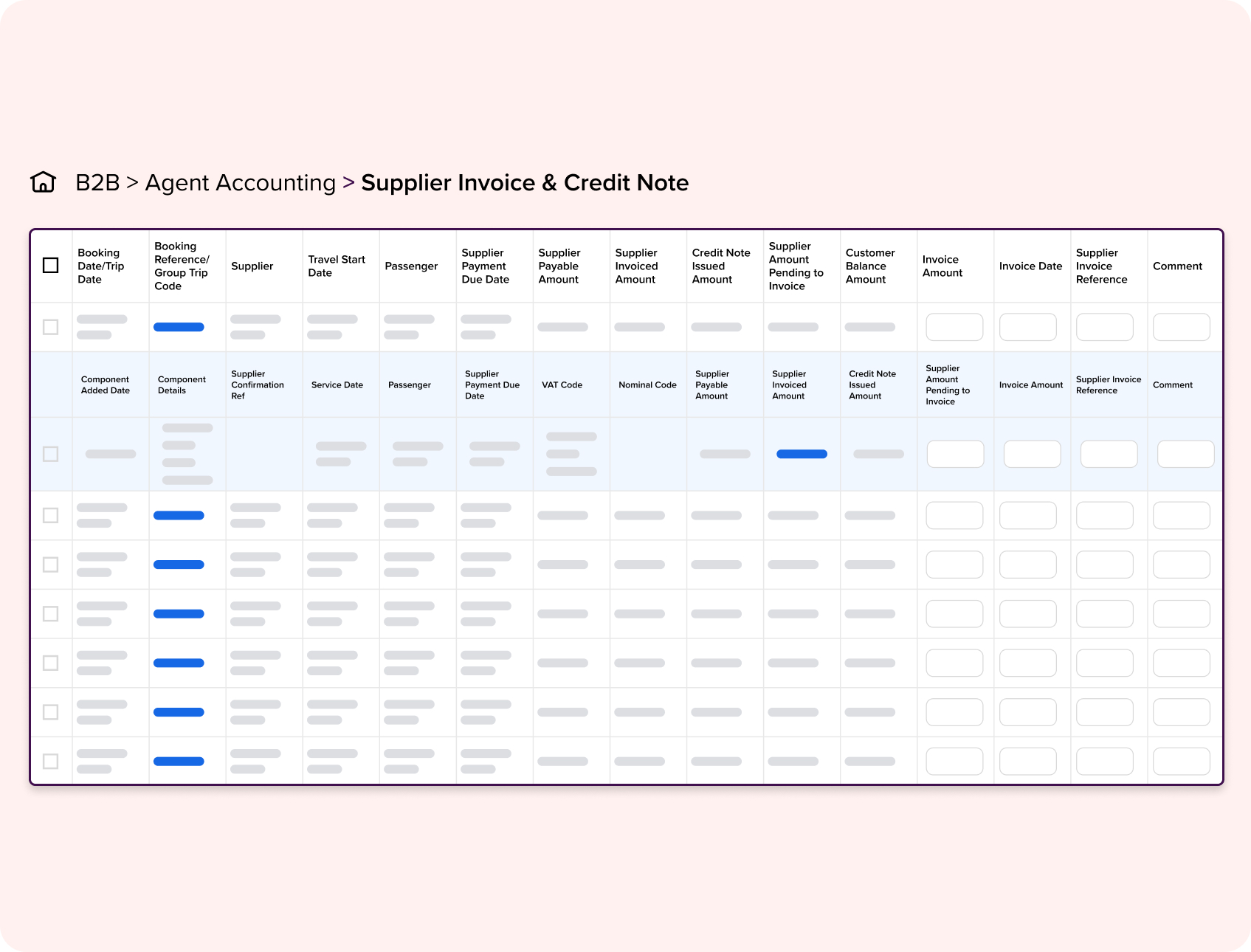

Agent Accounting & Commissions

- Set credit limits, payment rules for agents and homeworkers.

- Calculate and manage agent commissions automatically.

- Track VAT accurately and generate tax-compliant invoices.

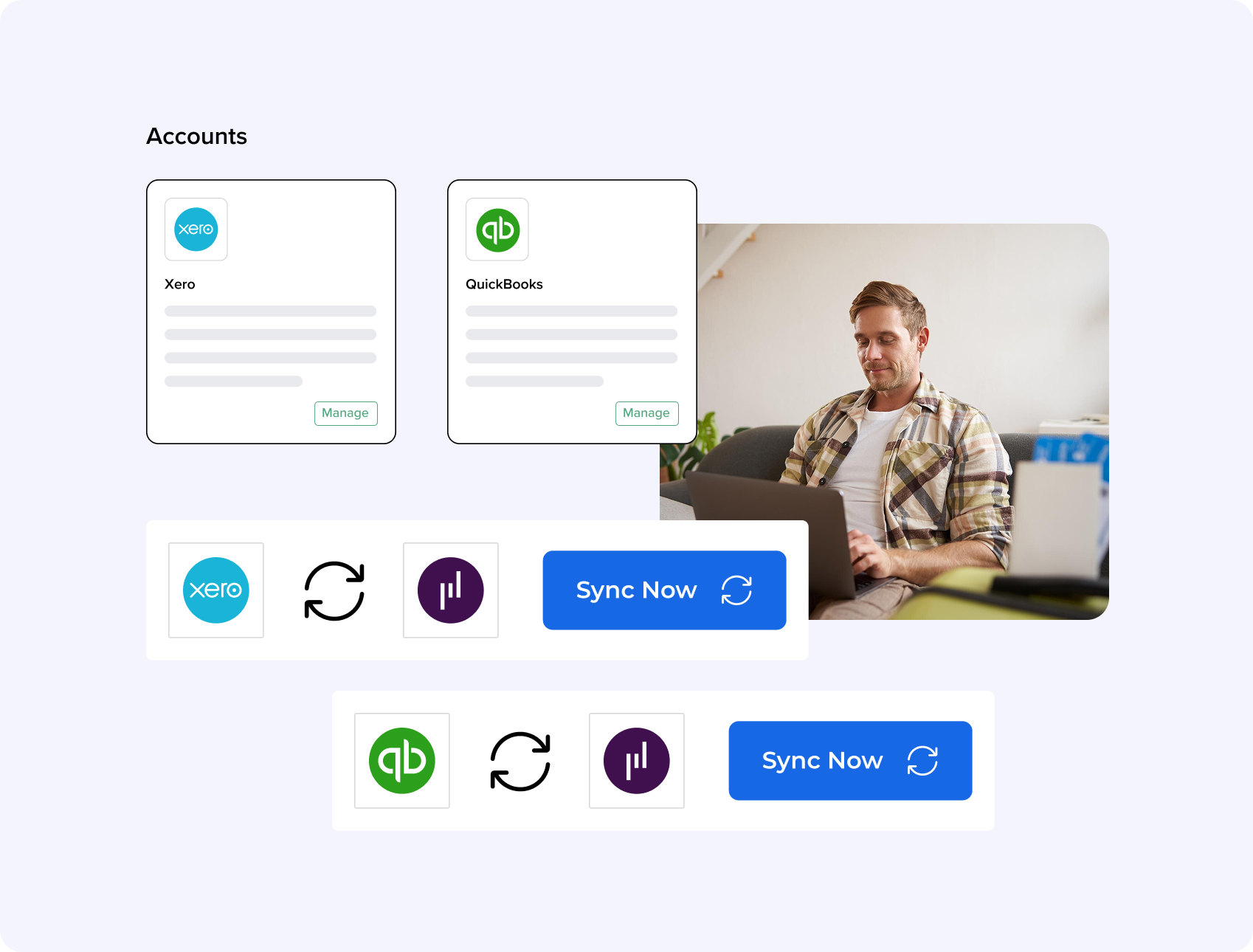

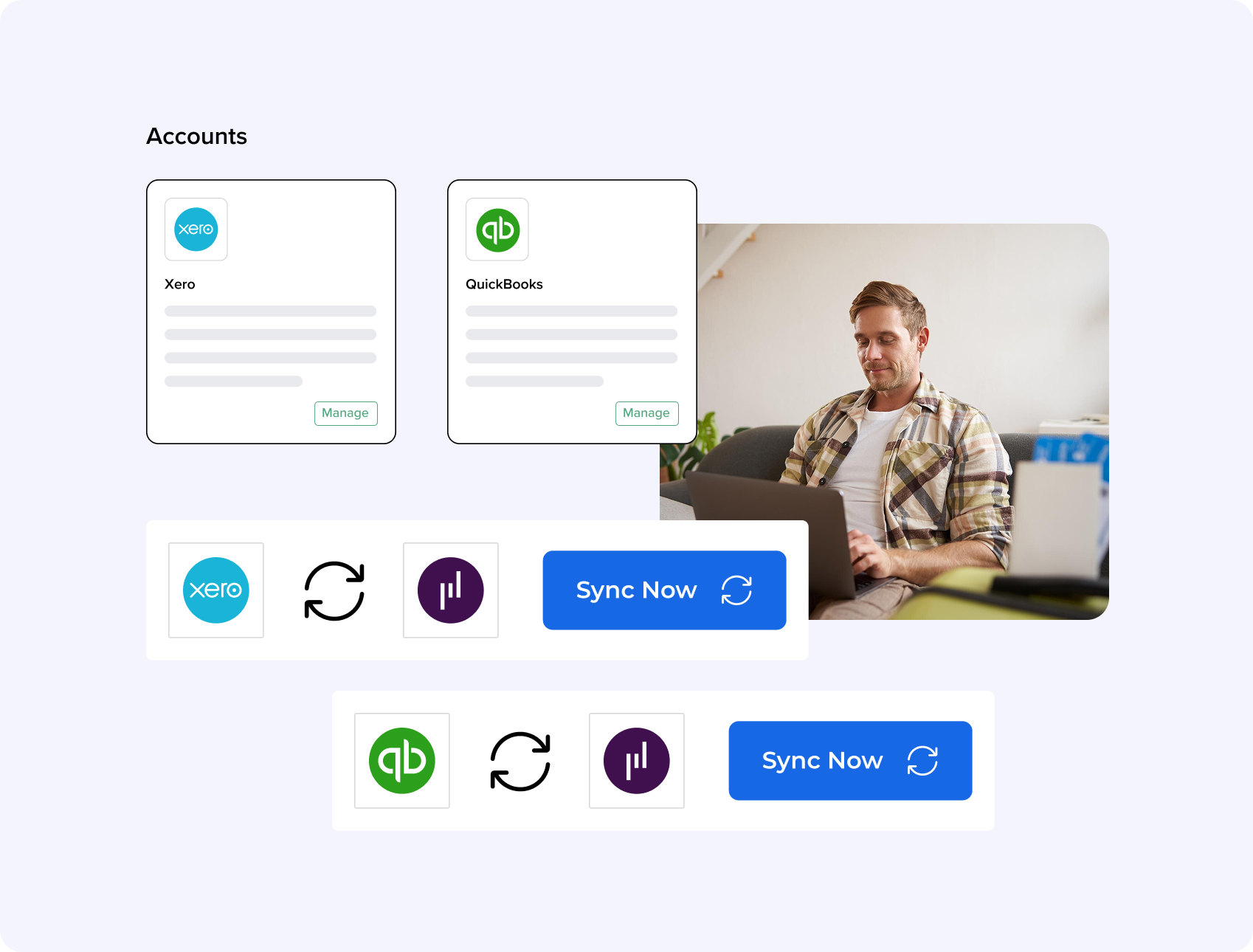

Accounting Software Integrations

- Connect seamlessly with platforms such as Xero and QuickBooks.

- Sync financial data automatically between systems.

- Reduce errors and manual entries with real-time syncing.

Multi-Currency Transactions

- Record transactions across currencies with full accuracy.

- Track exchange rate fluctuations with ease.

- Enable transparency for travel payments and reporting.

Invoice Consolidation & Customisation

- Combine multiple bookings into a single invoice.

- Choose between gross or net invoicing structures.

- Log and reconcile full or partial payments confidently.

Additional Features

Credit Note Tracking

Issue and track credit notes for travel booking cancellations, refunds, or service adjustments.

Global Accounting Compliance

Ensure compliance with global financial standards for multi-region travel operations.

Financial Summary

View financial performance, profit, and cost breakdown per travel booking.

Export Reports

Export sales and purchase invoices for integration with third-party accounting platforms.

Booking Statement / Proforma Invoice

Instantly generate and send booking statements to clients or agents.

Connect the Dots in Travel Accounting — From Sales to Ledger

Travel Accounting Benefits That Keep Finances on Track